Calculating cost of borrowing

Service website has a mortgage calculator and mortgage affordability. The interest cost over 25 years in 50053.

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

Even if the difference in interest rate is only half a percentage point the.

. Use this calculator to estimate interest deductions and cost of borrowing savings. Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan. Ad Rich options pricing data and highest quality analytics for institutional use.

Get Instantly Matched with the Best Personal Loan Option for You. Our calculator shows you the total cost of a loan expressed as the annual percentage rate or APR. W5Cost of the Asset at 31122013 250002000015000 6545 66545.

W4 Weighted Average Borrowing Cost Rate. 55 APR Representative based on a. Calculation results are approximations and for information purposes only.

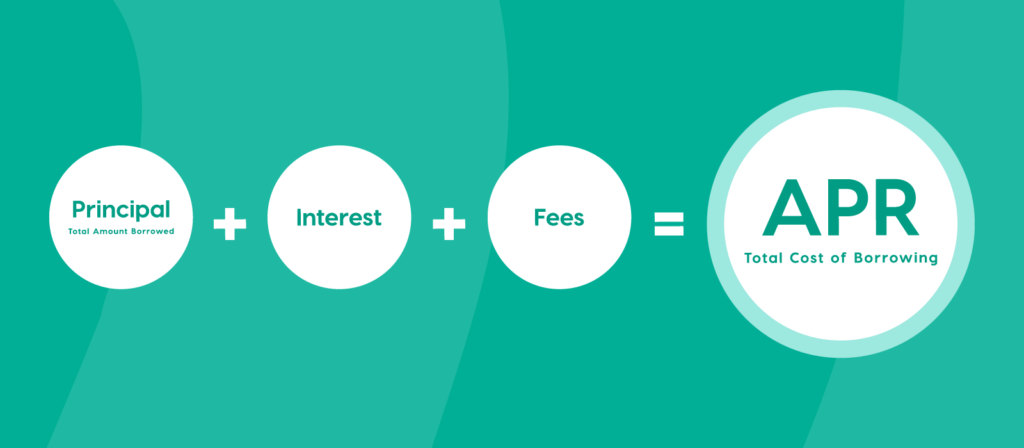

Interest is accrued daily and charged as per the payment frequency. Annual percentage rate or APR is the total cost of borrowing from a financial institution over one year. To Use the online Loan Calculator 1 simply.

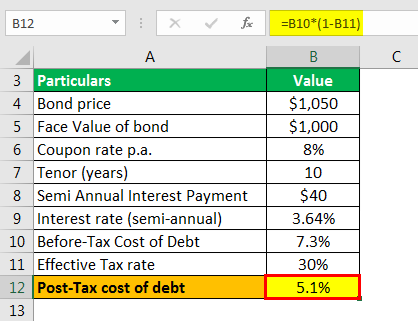

Type into the personal loan calculator the Loan. Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. Calculating after-tax cost of debt.

If the effective tax rate on all of your debts is 53 and your tax rate is 30. There are plenty of factors that come into play when calculating the cost of borrowing. For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500.

The interest cost over 25 years in 50053. APR Annual Percentage Rate APR shows the total amount a debt would cost if you borrowed the money for one year. Skip the Bank Save.

Choose how much you want to save or borrow. Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Even if the difference in interest rate is only half a percentage point the.

How to use our calculator. We calculate the monthly payment taking into account. You must however pay back 250000 to the lender.

MoneySuperMarkets loan calculator is designed to give you an idea how much a personal loan is going to cost. How APR the cost of borrowing is calculated. Compare More Than Just Rates.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Deep Historical Options Data with complete OPRA Coverage. W4 Weighted Average Borrowing Cost Rate.

Click Now Apply Online. Required Calculate the eligible. This will show you how the interest rate affects.

The frequency of repayments for. Analytic and Tick Data. If APR were a puzzle it would have many pieces.

Annual percentage rate is a good way to calculate the cost of. Deep Historical Options Data with complete OPRA Coverage. It can also be described alternatively.

Lets take the example from the previous section. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Build Your Future With a Firm that has 85 Years of Investment Experience.

The new AIR is 1392 and the. Explore our loan calculators and other tools to estimate your payments see the cost savings of a particular borrowing strategy and more. Analytic and Tick Data.

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Ad Rich options pricing data and highest quality analytics for institutional use. Find A Lender That Offers Great Service.

APR is expressed as a percentage of the original amount borrowed the. To do the cost of. Our quick and easy Debt Consolidation calculator.

Enter the amount into the box. Choose a borrowing solution thats right for you. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow the interest rate how much time you have to pay it back your credit score and.

To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Use the slider to set the.

The cost of borrowing varies depending on the type of loan you take out so its important to ask.

Excel Formula Calculate Payment For A Loan Exceljet

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

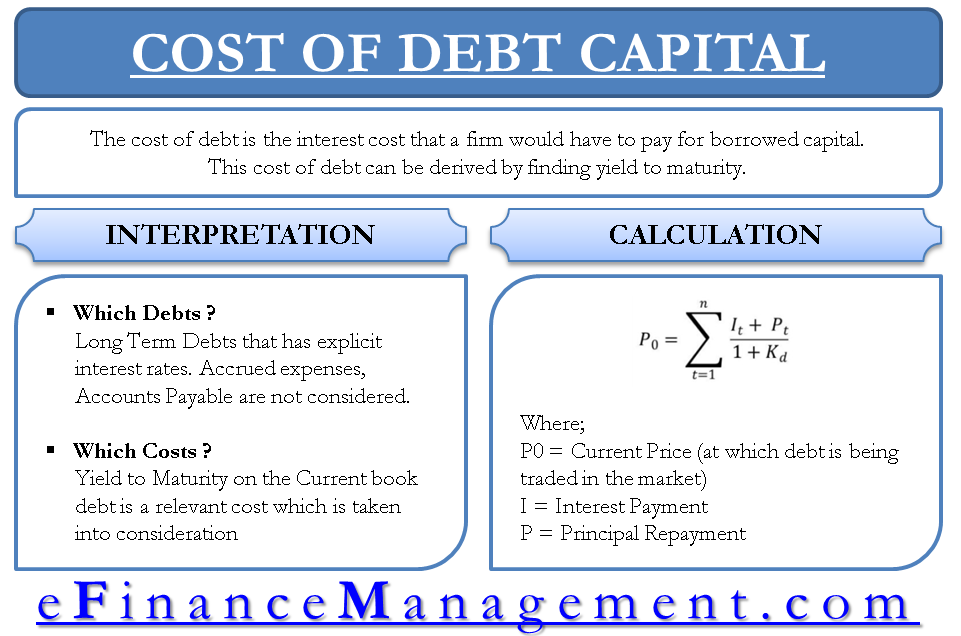

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Pin On Business News

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Learn The True Cost Of Borrowing Birchwood Credit

Cost Of Debt Capital For Evaluating New Projects Yield To Maturity In 2022 Accounting Books Accounting Basics Accounting And Finance

Understand The Total Cost Of Borrowing Wells Fargo

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Pin By Sh Investments On Random Mortgage Online Mortgage Real Estate Information